Prosthesis

is an artificial limb used by an amputee to compensate for the partial function

of a missing limb. There are upper limb prosthesis and lower limb prosthesis. Prosthesis

is often made of aluminum plate, wood, leather, plastic and other materials,

its joints are made of metal parts, now the mainstream of the prosthetic

industry is titanium alloy and carbon fiber materials. The above knee prosthesis

is custom-made for amputees above the knee. It consists of fossa, knee joint,

tibial canal, false foot and ankle joint. Sometimes, depending on the

suspension system the patient is using, the prosthesis may also consist of a

sleeve or other strap.

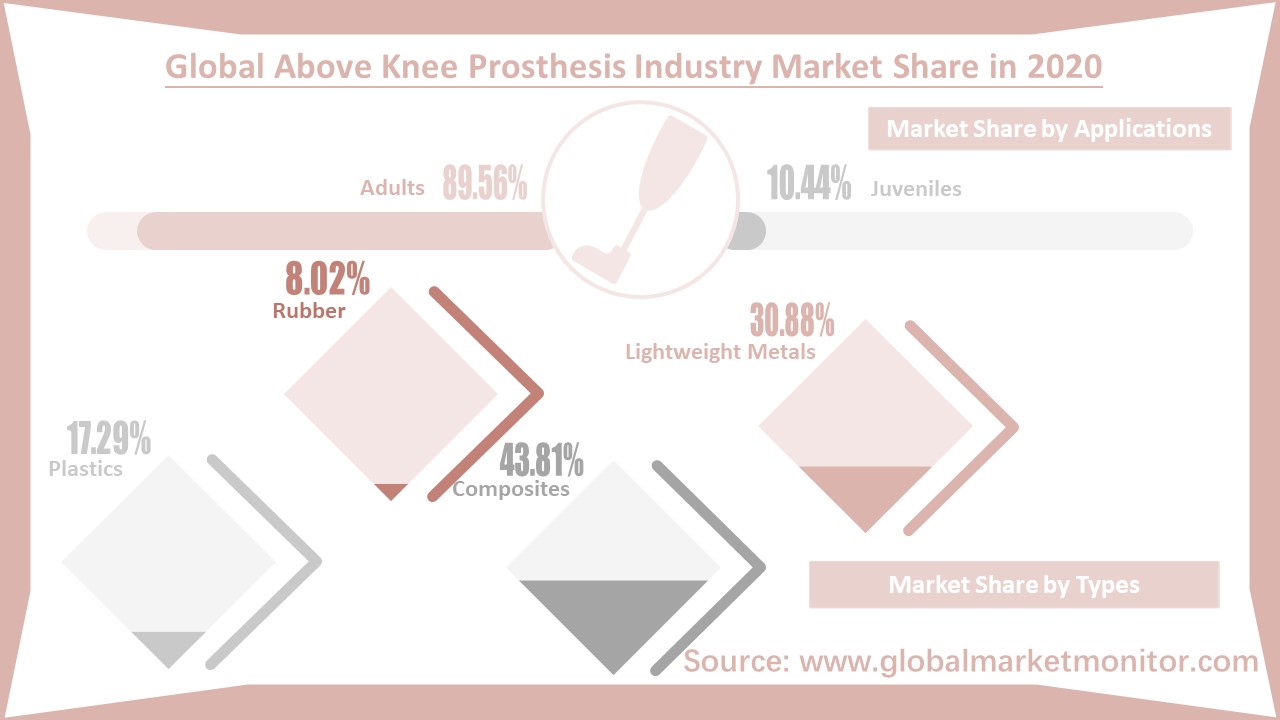

According

to the different materials used, the types of knee prostheses can be divided

into plastic, rubber, lightweight metal and composite materials. At present,

lightweight metal materials and composite materials, such as carbon fiber and

glass fiber, are the mainstream of the market due to their better performance. In

2020, lightweight metal and composite artificial limbs accounted for 30.88% and

43.81% of the market, respectively, while rubber and plastic products only

accounted for 8.02% and 17.29% of the market, respectively.

Users

can be divided into teenagers and adults according to different age groups. Adults

are generally more at risk and more likely to use prosthetics than juveniles. Therefore,

adults are the mainstream of the current market. In 2020, adult prostheses

accounted for 89.56% of the global market.

Data

show that North America is the largest market by revenue for the above knee

prosthesis industry. In 2015, North America accounted for 48.34% of the

industry market,with the revenue

of $392.70 million. By 2020, the total market revenue in the region increased

to $588.28 million, while the market share decreased to 48.15% compared with

2015; Europe came in second with $521.97

million of market revenue and 42.72% of the market. The rest of the world has a

smaller share of the industry, below 5%. In recent years, North America and

Europe have seen an aging trend, further catalyzed by falling fertility rates,

forcing governments to encourage more births. These two regions are also the

gathering places of developed countries. In terms of economic strength,

scientific and technological strength, talent reserve and residents consumption power, they far exceed other regions, which provides a good

economic foundation and support for the development of the industry. In addition,

with the development of the economy, emerging economies are in the spotlight.China,

Japan and other countries with rapid economic growth may usher in some

opportunities.

The

global market concentration of the knee prosthesis industry is high, and the

top 3 companies occupy about 70% of the market share. The top 3 companies are

Ottobock, Ossur and Blatchford, with a market share of 39.39%, 26.04% and

3.17%, respectively, in 2020. Ottobock is a German prosthetics company

specializing in the innovation of prosthetics.

Typical of these is the C-leg, a computerized knee that adapts to different walking gaits of patients by changing passive resistance. Ossur is

headquartered in Reykjavik, Iceland, with offices in the Americas, Europe and

Asia, as well as distributors in other markets. The company develops,

manufactures and markets non-invasive orthopaedic devices, including stents and

stent products, compression therapy and prosthetics. Blatchford is a UK company whose business

range includes repairing technology, custom seat solutions and orthopaedic

equipment.

According to our research, the total market revenue of the global above knee prosthesis industry was $812.43 million in 2015 and increased to $1221.73 million in 2020. Based on this, we performed a series of functional calculations and derived the data for the next five years by using scientific models. Finally, we predict that the total revenue of the global market for knee prosthetics will reach $1,855.56 million by 2025.

View the full TOC at: https://www.globalmarketmonitor.com/reports/762752-above-knee-prosthetics-market-report.html

The Rising Prevalence of Diabetes Worldwide Has Brought Development

Opportunities for the Industry of Above Knee Prosthesis. High prices are Barriers

to Market Expansion

Above

knee amputation (AKA) is a common complication of diabetes. In some cases,

diabetes can cause peripheral artery disease (PAD), which narrows blood vessels

and reduces blood flow to the legs and feet. Over time, the legs and feet can

become gangrene from lack of oxygen and blood vessels, leading to amputation. According

to the World Health Organization, the number of people with diabetes increased

from 108 million in 1980 to 422 million in 2014. According to the International

Diabetes Federation (IDF), about 463 million adults aged 20-79 have diabetes; By

2045, that number will rise to 700 million. With the increase of diabetes

patients worldwide, the incidence of AKA will increase, which will promote the

development of the industry.

In

addition, technological advances and product upgrades can better meet customer

needs, resulting in sales growth and ultimately promote the development of the

industry. In recent years, knee prostheses have been updated and improved in design

using hydraulic systems, carbon fiber, mechanical connections, electric motors,

computer microprocessors and an innovative combination of these technologies to

give users more control. New plastics and other materials, such as carbon fiber,

make prosthetics stronger and lighter, thereby avoiding the extra energy

required to operate them; High strength thermoplastics can be customized for

patients; Cutting-edge materials, such as carbon fiber and titanium, provide

strength and durability, while also making the limb lighter; In addition, more

sophisticated prostheses have advanced electronics that can provide additional

stability.

View the full TOC at: https://www.globalmarketmonitor.com/reports/762752-above-knee-prosthetics-market-report.html

We provide more professional and intelligent market reports to complement your business decisions.