In recent years, robots have been used not only in

industry, but also in medical systems. Current research

on the use of robots in the medical community is focused on surgical robots,

rehabilitation robots, nursing robots and service robots.

A surgical robot is a combined device of a group of

instruments. It is usually assembled from a device such as an endoscope,

surgical instruments such as scissors, a miniature camera and a joystick. According to foreign manufacturers, the surgical robots currently in use

work on the principle of surgical operations carried out wirelessly, i.e. the

doctor sits in front of a computer monitor and carefully observes the lesion in

the patient\'s body through the monitor and endoscope, and then removes the

lesion precisely by means of a scalpel in the robot\'s hands.Surgical robots are

among the most widely used and promising, offering powerful capabilities to

overcome the poor precision, long operating times, surgeon fatigue and lack of

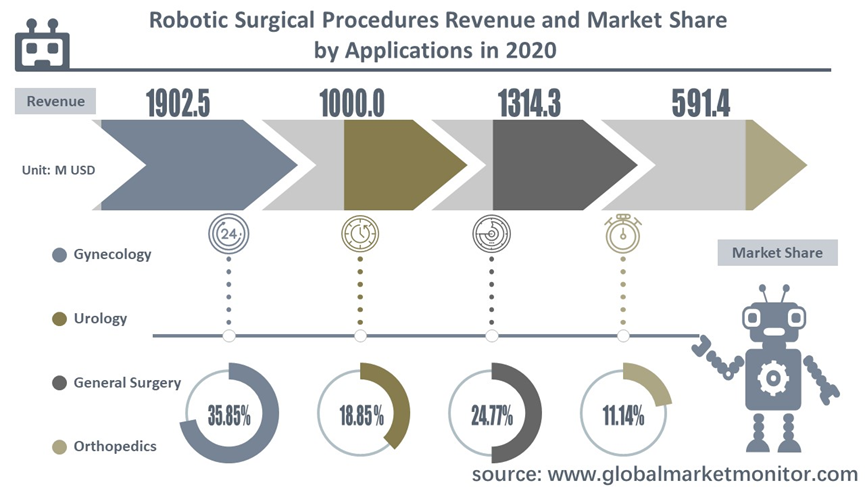

3D precision vision found in traditional surgical procedures. Its market is segmented into several major sections, such as gynaecology,

urology, general surgery, orthopaedics. etc. Gynecology holds a significant

share in terms of application and is expected to reach 34.05% of revenue by

2030, growing at a CAGR of 18.87% during 2020 and 2030.

Get

the complete sample, please click:https://www.globalmarketmonitor.com/reports/762636-robotic-surgical-procedures-market-report.html

Surgical Robotics Market

Analysis

The global medical robotics market is expected to

reach US$ 18,000 million by 2020. Of this, the market for surgical robots is

expected to reach USD 6,000 million, with the consumables segment contributing

more than 50%.

Surgical robots are growing at an average rate of

14% globally and over 23% in Asia Pacific. Such a growth rate is extremely rare

in the medical device sector and has therefore received a high level of

attention from the technology, medical and investment sectors.

The surgical operation robot, represented by the da

Vinci robot, started in the field of urology and its disease areas have rapidly

expanded to include general surgery, gynaecology, hepatobiliary surgery,

vascular surgery, paediatric surgery, thoracic surgery, cardiac surgery and

many other departments.

Global revenue in 2019 is US$4400 Mn, of which

consumables revenue contributes US$2400 Mn and net profit is over 30%. Other

international giants in the medical field are also heavily involved in the

field of surgical robotics. Surgical robots are becoming an important direction

in the development of surgery.

Analysis of the Domestic Competitive

Landscape for Surgical Robots

The domestic operating class surgical robot market

started late, and there are no enterprises with scale yet, most companies are

still in the stage of research and development, animal experiments, clinical

experiments, research direction to single-hole, laparoscopic surgery system

with flexible robotic arm is the main. Positioning class

surgical robots, represented by Tianzhihang, Huazhi minimally invasive,

Parkwise Wellcome and Huake Precision, have been industrialised or are about to

be industrialised.

So far, nine domestic surgical robots have been

marketed, including two orthopaedic surgical robots by Tianzhihang, five

neurosurgical robots by Baihuiwei Kang, Huake Precision and Huazhi Minimally

Invasive, and the first domestic oral surgery robot "Ruimab" by

Baihuiwei Kang.

From the layout of the industry chain, in the field

of operating robots, Jingfeng Medical\'s single-hole laparoscopic surgical robot

may adopt a design close to that of the da Vinci surgical robot, and is the

only company in China and the second company in the world that has mastered

both single-hole surgical robot and multi-hole surgical robot technology. It

has formed a complete intellectual property system and applied for more than

300 patents at home and abroad.

In the field of positioning class robots,

Tianzhihang has carried out horizontal expansion in different medical device

fields in the midstream segment: in 2017, Tianzhihang invested in French

company SPW to lay out the field of orthopaedic spine class high-value

consumables; in 2018, Tianzhihang invested in US company GYS and US company

Mobius to start to involve in the field of mobile CT in the field of imaging

equipment, which is expected to reduce the industry chain penetration of

horizontal midstream products through The company is expected to reduce product

costs through the integration of horizontal midstream products. Huake Precision has a good channel base to boost the marketing of its

surgical robot products: the company\'s electrode products already occupy 90% of

the market share in the field of neurosurgery in China, and its extensive sales

channels are expected to boost the development of its surgical robots. As one of the first stereotactic robots, Huazhi\'s CAS-R series has now

nationalised its components and the procedures it covers have been reimbursed

by Beijing Medical Insurance.

In terms of market space, the surgical handling

robot is oriented to a wide range of clinical areas, with a large volume of

surgery and a large potential future market. With big water and big fish, it is easy to gather resources in many

aspects, such as technology, talent and capital. From the industry stage, da

Vinci has gone through a long period of market education, allowing the surgical

operation robot industry to pass the cognitive period and begin to enter the

development period, while its related patents gradually expire and

opportunities begin to emerge for domestic manufacturers. With Tianjin University and HUST as the source of technology, a number of

companies with relatively mature products have emerged. From the policy

environment, due to the number of configuration certificates, which limit the

amount of da Vinci installed, there will be inclined support in the future for

domestic products.

Domestic surgical robots with capability and

technology have the opportunity to grow faster. At the same time, the

recognition of Tianzhihang by the Science and Technology Board is a testament

to the positive attitude of the capital market in embracing hardcore

technology. In terms of segmentation, there must be a differentiation advantage.

Despite the banner of localisation, to impress the mainstream PI, one needs to

find differentiating features, procedures, product design, consumables design,

indication areas, etc. This will make it easy to get clinical and capital

market recognition. Among the domestic surgical robots, there are very good

companies in the direction of multi-hole, single-hole and flexible robots,

which deserve attention.

Get

the complete sample, please click:https://www.globalmarketmonitor.com/reports/762636-robotic-surgical-procedures-market-report.html

We provide more professional and intelligent market reports to complement your business decisions.