Neobank is also called Internet banking, refers to a bank to use the network technology, through the network to provide customers open an account, query, reconciliation, industry transfer, an inter-bank transfer finance and investment, credit, online securities, such as traditional services, the customers can never leave home can be safe and convenient management of current and time deposits, checks, credit CARDS and personal investment, etc. Can say, the bank on the net is the virtual bank counter on the network.

Generally speaking, the business varieties of neobank mainly include basic business, online investment, online shopping, personal finance, corporate banking and other financial services. Compared with traditional banking business, network banking can fully realize paperless transactions, with the advantages of convenient service, fast, efficient, reliable and low operating cost.

Neobank mainly focuses on payment system and processing services. According to the data, in 2020, the revenue of payment system and processing service of global neobank accounted for 38.56% and 34.50% respectively, while customer and channel management and risk management accounted for only 10.99% and 14.95% respectively. In terms of application subjects, large enterprises dominate the global neobank market, accounting for up to 72.79% of the market in 2020.

India will be an emerging market for neobank

The research shows that Europe is the largest revenue market for the global neobank industry. In 2015, the revenue of the European neobank market was $1794.31 million, which increased to $9596.35 million by 2020, accounting for 39.43% share of the global market. However, we predict that over the next few years, the European neobank market will gradually decline as a share of the global market, perhaps to 38.02% by 2025.

In 2020, the North American neobank market ranked second with market revenue of $7,274.64 million, accounting for 29.89% of the global market. The Asia-Pacific market followed closely with market revenue of $6,651.59 million, accounting for 27.33% share globally.

Since late 2019, the outbreak and spread of COVID-19 has accelerated customers\' digital acceptance of bank requirements. neobank is a kind of digital banking without physical bank branches and without obstacles such as traditional technology and outdated processes. These banks offer other banking options to other traditional financial institutions. In the past two years, with the rapid development of various industries in India, the local economy has also been rapidly developed, and its top online bank is innovating in the banking sector. For example, RazorpayX, the neobank platform for India\'s newest unicorn Razorpay, has served more than 10,000 businesses with Opfin payroll processing, corporate card payments, real-time payments from corporate vendors, and billions of dollars in base payments layer payments. These factors will drive the development of neobank industry in India, and India will become an emerging market for neobank industry.

Get complete sample,please click: https://www.globalmarketmonitor.com/reports/1229920-neobank-market-report.html

With 3A characteristics, conducive to service innovation, the global neobank market revenues show a linear growth

Neobank has broken the traditional banking area, time limit, have the characteristics of 3 a, can at any time (Anytime) (Anywhere), any place, in any way (Anyhow) provide financial services to the customers, it is helpful to attract and retain good customers, and actively expand the customer base, open up new profit source. In addition, neobank mainly uses public network resources and does not need to set up physical branches or business outlets. Therefore, neobank greatly reduces the operating costs of banks and effectively improves the profitability of banks.

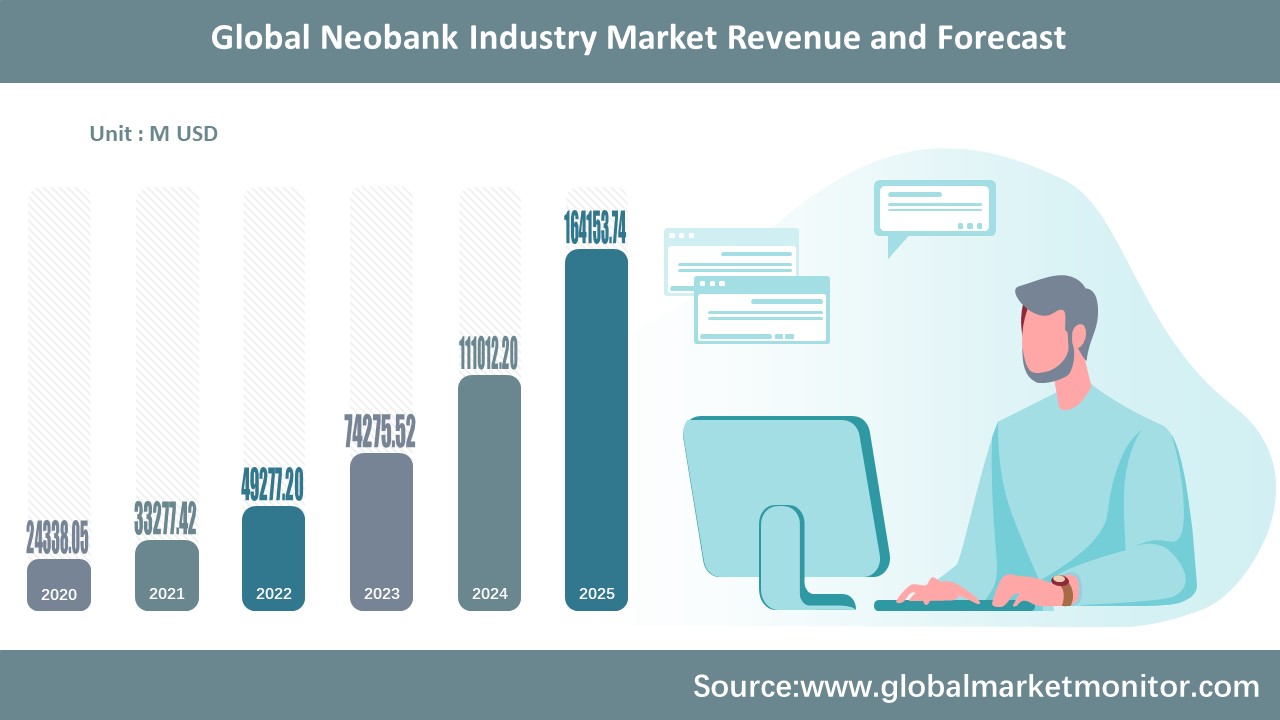

On the other hand, the establishment of neobank is conducive to service innovation, providing customers with a variety of personalized services. Using the Internet and the bank payment system, it is easy to meet customers\' needs of consulting, purchasing and trading a variety of financial products. In addition to banking, customers can also easily buy and sell stocks and bonds online. Neobank can provide customers with more appropriate personalized financial services. Overall, many advantages of neobank are the main factors for the rapid market growth of this industry. Data show that in 2015, the global neobank market revenue was $4,279.89 million, and has been growing rapidly since then, reaching $24,338.05 million by 2020, with a compound annual growth rate (CAGR) of 41.57% from 2015 to 2020.

In recent years, the way people bank is changing, and for many, banking is going completely digital. Much of this is thanks to neobank: small start-ups often have no physical outlets and require account holders to conduct transactions online or on smartphones. The products of old banks are also increasingly turning to the Internet, and the trend of neobank is becoming more and more obvious. The change of banking model will be combined with digitalization and develop rapidly, thus promoting the development of the neobank industry.

Neobank\'s product model tends to be oriented towards tech-savvy customers, who are generally looking for simpler and more convenient ways to manage their money. Many schools offer free budgeting tools and financial education. Because most branches of neobank have lower administrative costs, fewer staff to run them and typically leaner business models, users can often enjoy higher interest rates and lower fees.

Most online banks do not offer credit, which helps reduce costs and limit risk. Most of these banks also offer physical debit cards to avoid compromising the user experience. All these factors will increase people\'s demand for neobank and promote the development of the industry.

However, the competition in the banking technology industry is very fierce, and the market companies are constantly developing new products to occupy the market share. The more fierce market competition will bring greater challenges to small companies.

The disadvantage of not having a physical branch is that users cannot talk to the bank face to face. Face-to-face communication with employees can build a harmonious relationship and trust. There are no physical branches in the bank, only online communication. Therefore, if users do not feel safe, they will not choose neobank, and users will lack trust in neobank. Lack of loyal customer base will affect the development of the company.

Get complete sample,please click: https://www.globalmarketmonitor.com/reports/1229920-neobank-market-report.html