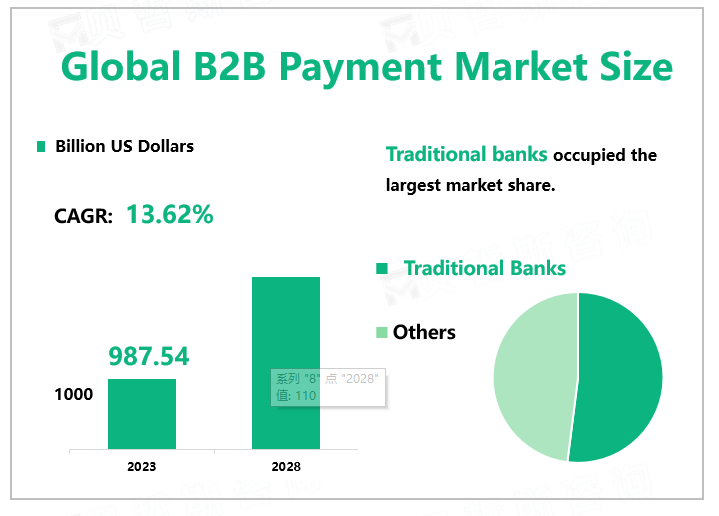

Global B2B Payments Market Overview

According to Global Market Monitor, the global B2B payment industry market size was $987.54 billion in 2023 with a CAGR of 13.62% from 2023 to 2028. By type, the traditional bank segment accounted for the largest share in 2023. By application, the energy and electricity segment occupied the biggest share with 35.06% in 2023.

The Growth of Global Trade Activity and the E-commerce Industry

B2B payments are the exchange of currency for goods or services between two businesses. This is an inter-commerce transaction without a consumer.

The growth of the global population, economic development, and the popularization of the Internet have provided a strong foundation for the growth of global trade activities. E-commerce refers to business activities centered on commodity exchange with information network technology as the means. The growth of global trade activities and the widespread application of Internet information technology, provide a good foundation for the rapid development of e-commerce. Compared with the B2C e-commerce market, the B2B e-commerce market has developed more rapidly. The strong growth of the B2B e-commerce market provides opportunities for the development of B2B payments.

The Development of Technology and Increase of Cross-border Payments

As the Internet and mobile Internet, as the infrastructure and economic ecology are spreading globally, global innovation in the field of financial technology can be described as rapid. Payment is an indispensable and important link in the financial field and even in the closed-loop business. Cross-border payment is experiencing vigorous development with the maturity of technology and the development of the market. The increase in cross-border payments has become an important driving force for the development of B2B payments.

Compared with B2C, the Application of Electronic B2B Payment Lags Behind Obviously

Compared with B2C, the application of electronic B2B payment in various industries lags obviously. Many invoices are still processed manually and paid by cheque. This delay may be due to several reasons, including a lack of investment in IT infrastructure needed to facilitate electronic payments, a lack of interoperability between payment applications or accounting systems, and so on. There are still many problems in the digital B2B payment industry that need to be resolved, which leads to the need to increase the penetration rate of B2B payments.

|

S |

Changes in customer behavior and growth in online payments are driving the growth of the B2B payment market. |

|

The development of B2B payment technology |

|

|

W |

The entry of new market participants in the B2B payment industry has led to increased competition among participants. |

|

The risks of electronic B2B payments |

|

|

O |

The growth of global trade activity and the development of the e-commerce industry |

|

Digital adoption and trends in business process automation |

|

|

Increase in cross-border payments |

|

|

T |

COVID-19 and reduced economic activity hurt the B2B payment industry. |

|

Compared with B2C, the application of electronic B2B payment in various industries is lagging behind. |

We provide more professional and intelligent market reports to complement your business decisions.