Cement is a kind of powder hydraulic cementing material, which is mixed with water into plastic slurry and can cement sand, stone and other materials and can be hardened both in air and water. According to the different use and performance, cement can be divided into general cement, special cement and characteristic cement three types. General purpose cement is the cement used in civil engineering; Characteristic cement is the cement with special properties or uses, such as road Portland cement, G grade oil well cement, etc. Special cement is named for its specific purpose and can be made in different sizes.

From the perspective of industry chain, the upstream raw materials of cement manufacturing mainly include limestone, clay and correction materials, among which limestone accounts for 70% to 75% of the cost of raw materials, is the most important raw materials; Its downstream demand mainly comes from infrastructure construction, real estate development and so on. Cement is a basic building material which cannot be replaced and reused at present. The development of cement industry reflects the stage and characteristics of the development of national economy to some extent.

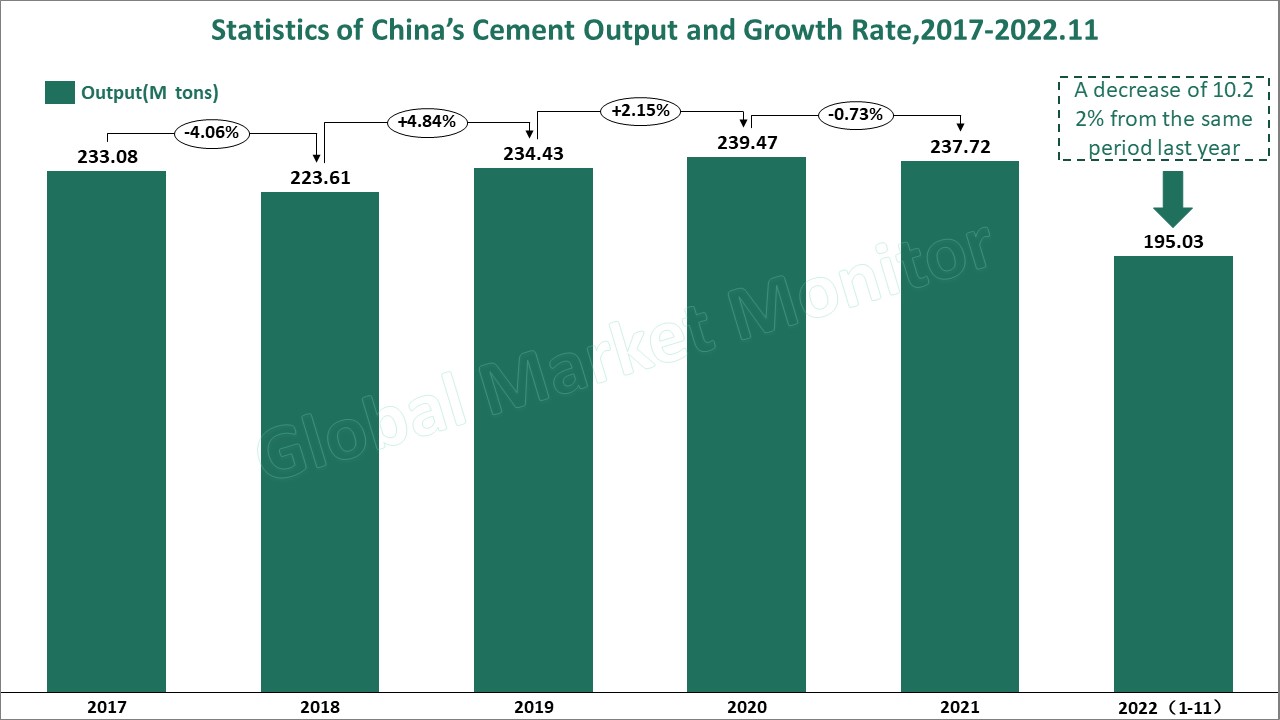

In terms of output, China\'s cement output fluctuated between 2.2 billion tons and 2.5 billion tons from 2017 to 2021, according to the National Bureau of Statistics. In 2018, China\'s cement output experienced negative growth, mainly because the country vigorously promoted supply-side structural reform in the cement industry and resolutely fought the battle against pollution against the background of serious overcapacity. Through the comprehensive implementation of the industrial policy of "off-peak production", the promotion of industry self-discipline, "kiln stop limit production" and other measures, the cement industry has effectively resolved serious overcapacity and reduced pollution emissions, but also maintained the dynamic balance of supply and demand in most regional markets. Then, as the problem of overcapacity was gradually solved, China\'s cement output gradually rebounded, increasing to 2.394 billion tons in 2020. However, due to the poor development of the real estate industry in 2021, the demand for cement was also affected to some extent, so the production volume decreased by 0.73% year-on-year to 2.377 billion tons. In 2022, as of November, China\'s cement production totaled 1.950 billion tons, 222 million tons less than the same period in 2021.

Source: National Bureau of Statistics, Market Monitor Co., Limited.

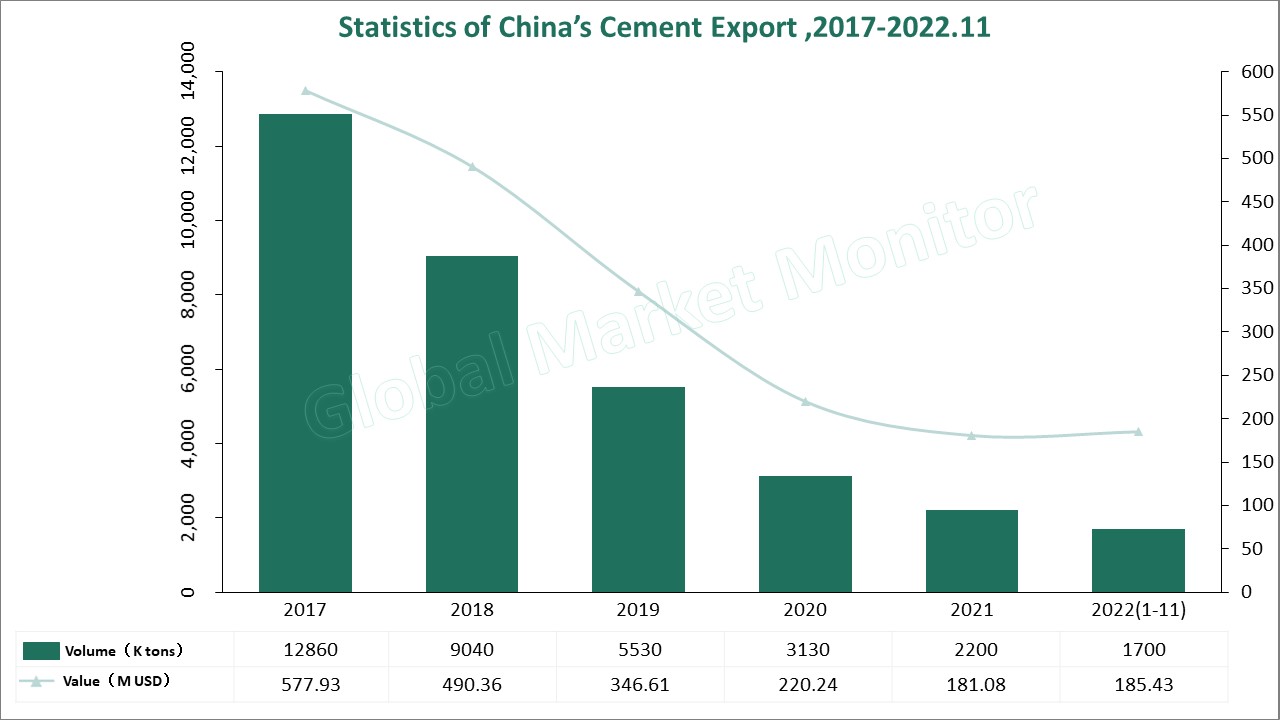

From the perspective of export, since 2017, the export volume of cement has been decreasing year by year. The main reason lies in the adjustment of export policy. In 2007, the government cancelled the preferential policy of 11% export tax rebate. On the other hand, the international market demand is weak, the cement demand gap narrowed, especially the original export of the United States real estate industry investment slump, resulting in a substantial reduction in the import of cement. Data showed that China\'s cement exports only reached 9.04 million tons in 2018, falling below 10 million tons for the first time since 2005. By 2021, exports had fallen to just 2.2 million tons, worth $181.08 million; In 2022, the country exported 1.7 million tons of cement and $185.43 million as of November, indicating an upward trend in cement prices.

Source: National Bureau of Statistics, Market Monitor Co., Limited.

In recent years, due to the impact of the epidemic, social and economic growth is under great pressure. The state has introduced policies to support the development of infrastructure, real estate and other pillar industries of the national economy. At the same time, with the release of the epidemic policy, social and economic development will accelerate, the vitality of the national economy will recover, then the demand and output of China\'s cement is expected to rise. On the other hand, as China’s "double carbon goal" approaches, our environmental protection policy will be further strengthened in the future. The double pressure of carbon tax and emission reduction reform will make the environmental protection cost of small enterprises increase dramatically, and the strong enterprises may merge and acquire small enterprises, and the market concentration of Chinese cement industry will be further improved. The surrender policy will guarantee the construction of overdue residential projects. In addition, some provinces and cities have gradually loosened restrictions on house purchases, and the recovery of the real estate market will boost the demand of the cement market.

For more information on the industry, please refer to the latest 《Global and Regional Cement Market Details Research Report 2023-2028》released by Market Monitor Co., Limited.

Copyright note: This article is from Market Monitor Co., Limited, if there is any content, copyright or other questions, please contact info@globalmarketmonitor.com, we will promptly communicate and deal with.