Global Textile Machinery Market Overview

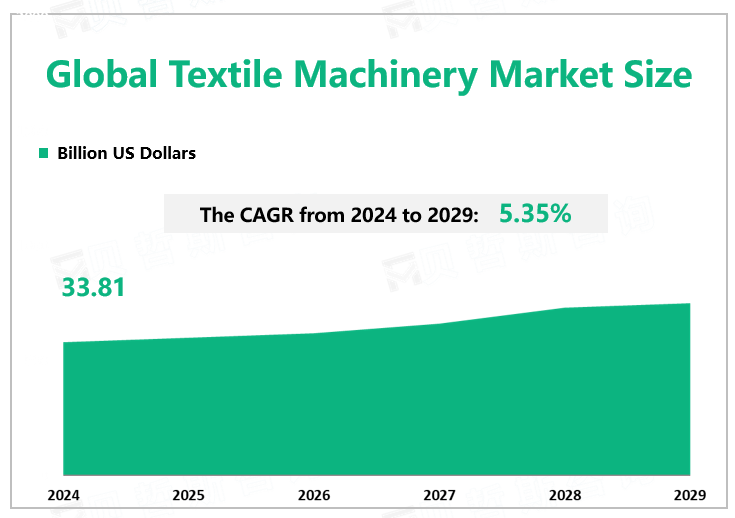

According to Global Market Monitor, the global textile machines market size will reach $33.81 billion in 2024 with a CAGR of 5.35% from 2024 to 2029.

Market Trends

The textile industry involves many production links, raw material types, and technological methods, which need the support of many kinds of Textile Machinery. Textile Machinery plays an important role in all links of the textile industry chain. To improve production efficiency and product quality, the requirements of the textile industry for the efficiency, reliability, automation, and intelligence of Textile Machinery are constantly improving. Textile Machinery manufacturing needs to deeply integrate textile processing with many disciplines such as machinery manufacturing, sensing technology, automatic control technology, and information technology. The demand of textile enterprises for improving labor productivity and saving energy and consumption persists, which makes textile machinery develop in the direction of high efficiency, automation, intelligence, and energy saving.

The spinning machinery is expected to be the fastest-growing segment. Much of this segment's growth can be attributed to the expansion of the cotton-spinning machinery. The cotton spinning machine market is likely to be driven by rising demand for textile goods and environmentally friendly fibers in emerging countries. Europe is a significant producer of textile machines.

China is the Largest Textile Machinery Market.

China is currently the largest textile machinery market, with a large number of textile machinery manufacturing enterprises and sufficient production capacity. According to the National Bureau of Statistics, the number of enterprises above the designated size in China's textile machinery industry is 682 in 2022. Europe and Asia are the main research and development and production of textile machinery, the high-end market is mostly monopolized by foreign enterprises, such as Germany Dornier, Switzerland Rida, Italy Savio, Japan Murata, and other international well-known enterprises rely on technology, brand, and other advantages, in the field of textile machinery has a leading position. Domestic textile machinery enterprises in independent innovation, manufacturing process, product quality, brand reputation, and other aspects of the overall there is still a certain gap, in the high-end textile machinery market still has a large space for development.

Asia-Pacific is close to most of the countries that make clothes and textiles. This gives producers a huge chance to meet demand in the region. Automation is in great demand to lower operating costs in countries where production costs are high and labor is expensive. During the projected period, factors such as automation and rising demand are expected to provide substantial potential for manufacturers to meet the need for technologically upgraded cotton spinning machines.Japan, Mauritius, Italy, and Belgium were the top FDI providers to India's textile sector. India achieved its highest-ever Textiles and Apparel (T&A) and Handicrafts export total of USD 44.4 billion in FY 2021-2022.Because of schemes like the Pradhan Mantri Mega Integrated Textile Region and Apparel Parks, the Production Linked Incentive Scheme for Textiles, and the allocation for the National Technical Textiles Mission (NTTM), FDI may increase in the Indian textile industry in the future.

|

By Type |

Spinning Machinery |

|

Knitting Machinery |

|

|

Weaving Machinery |

|

|

Finishing Machinery |

|

|

Others |

|

|

The spinning machinery accounts for the largest share. |

|

|

By Application |

Woolen Textile Industry |

|

Chemical Fiber Industry |

|

|

Others |

|

|

The largest segment by application is the chemical fiber industry. |

|

|

By Region |

North America |

|

Europe |

|

|

China |

|

|

Japan |

|

|

Others |

|

|

China holds the largest market share. |

We provide more professional and intelligent market reports to complement your business decisions.