Global Meal Replacement Products Market

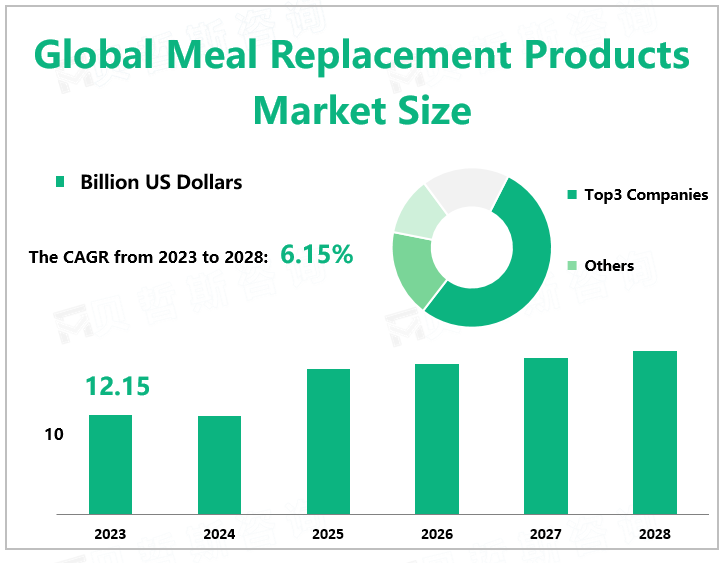

According to Global Market Monitor, the global meal replacement products market size was $12.15 billion in 2023 with a CAGR of 6.15% from 2023 to 2029.A meal replacement intends to as a substitute for a solid food meal, usually with controlled quantities of calories and nutrients. Some drinks are in the form of a health shake. Medically prescribed meal replacement drinks include the required vitamins and minerals.

Market Drivers

The food replacement market is driven mainly by factors such as busy lifestyles, rapid urbanization, healthy food consumption habits, and food convenience. Modern lifestyles have led to major changes in people's eating habits. Consumers are becoming more health-conscious and seeking convenience and more nutritious foods due to the high prevalence of obesity, diabetes, cardiovascular and other health-related problems among consumers. The increase in the number of fitness centers and clubs has also had a positive impact on the demand for high-protein meal replacement products.Abbott Labs (Ensure) is one of the major players operating in the meal replacement products market, holding a share of 26.82% in 2023.

The US Dominates the Market.

The US had the highest growth rate of all regions. According to the United States Department of Agriculture (USDA), Americans spend more than half their food budget on convenient foods, looking for small, time-saving meals. The availability of various types and flavors is an added factor driving the market. Meal replacement products are easy to store and have a longer shelf-life. The powdered form is one of the most popular product types, especially among fitness enthusiasts. Many gyms promote meal replacement products to inculcate healthy dieting habits among their clients.

Fierce Competition in the China Meal Replacement Products Market

In November 2019, the Chinese Nutrition Society issued the "Meal Replacement Food" group standard, which will be officially implemented from January 1, 2020. The group standard for meal replacement food definition, nutrition standards, labeling specifications, and other aspects of clear requirements. China's meal replacement industry is gradually maturing, and with the growth of Internet technology in the new era and the change in people's dietary concepts, the meal replacement industry will continue to flourish. There is still a certain gap in the size of China's meal replacement market compared with other developed countries, and there is still a large room for growth in the next few years.

The number of companies in China's meal replacement industry is rising rapidly, and by the end of 2022, there was about 5,000 meal replacement companies in China. The industry has low entry barriers and many entrants and will attract more entrants in the future. With the increasingly fierce market competition, how to enhance the competitiveness of the enterprise industry is a big test.

|

By Type |

RTD Products |

|

Energy Bars |

|

|

Powders |

|

|

Others |

|

|

RTD products segment contributes the largest market share. |

|

|

By Application |

Convenience Stores |

|

Hypermarkets/Supermarkets |

|

|

Specialty Stores |

|

|

Online Retailing |

|

|

Pharmacy |

|

|

The online retailing segment occupies the biggest share. |

We provide more professional and intelligent market reports to complement your business decisions.