Blockchain in energy refers to a new energy business model that utilizes blockchain technology to achieve transparency, traceability, and efficient collaboration in energy transactions, supply chain management, equipment maintenance, data sharing, and other aspects through decentralized, distributed ledgers, smart contracts, and other technological means in the energy industry.

Overview of Market Development and Analysis of Competitive Landscape

In today's high-tech and globalized world, blockchain technology, as an emerging information technology, is gradually changing our lives and business models. The application of blockchain technology in the global energy field has gradually expanded from simple pilot projects to a wider range of business areas, such as energy trading, supply chain management, smart contracts, etc.

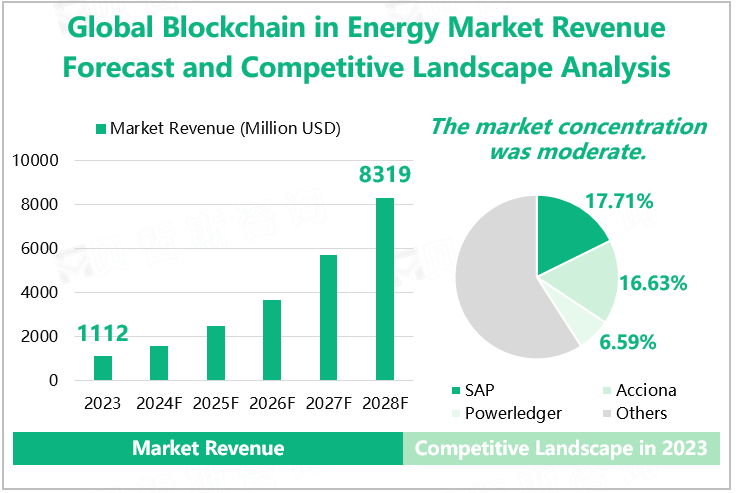

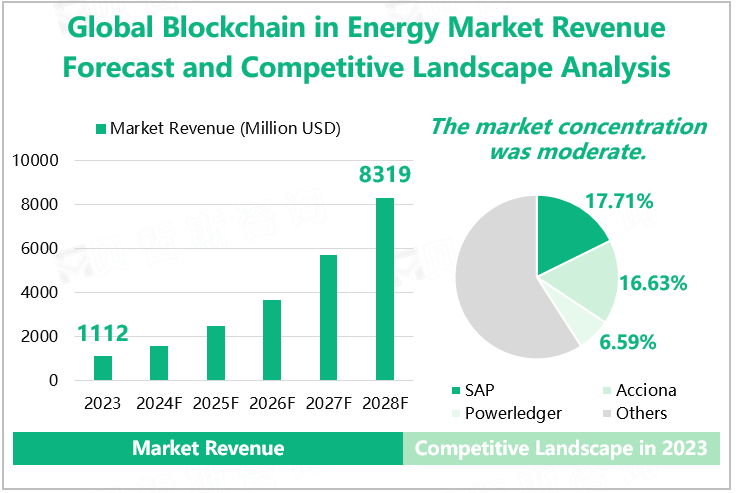

According to our research data, the global blockchain in energy market revenue in 2023 was $1112 billion, an increase of 51.10% compared to 2022. It is expected that the market size will continue to rapidly increase to $8319 million by 2028, with a compound annual growth rate (CAGR) estimated at 49.55% from 2023 to 2028.

From the perspective of market competition, the concentration of global blockchian in energy market is moderate. The data shows that in 2023, the total revenue of the blockchain in energy market of the top 3 enterprises in the industry was 40.93%. The top three companies were SAP, Acciona, and Powerledger, with blockchain in energy market revenue accounting for 17.71%, 16.63%, and 6.59% of the global market in 2023.

Global Blockchain in Energy Market Revenue Forecast and Competitive Landscape Analysis

Source: www.globalmarketmonitor.com

Segmented Market Analysis

According to the different network scopes, blockchain can be divided into four categories: public blockchain, private blockchain, federate blockchain, and hybrid blockchain. At present, public blockchain is the most widely used blockchain network. Public blockchain refers to a blockchain that can be read, sent, and effectively confirmed by anyone in the world, and can also participate in the consensus process. It has the strongest degree of decentralization and transparent ledger information, and all data on the chain is publicly available by default and cannot be changed. It belongs to a non-licensed chain.

Data shows that in 2023, the segment market revenue of the public blockchain in energy was $373 million, with a market share of 33.52%; Next is a private blockchain, with a market share of 28.53%.

From the perspective of application pattern, the application of blockchain in energy involves aspects such as wholesale electricity distribution, peer-to-peer energy trading, electricity data management, and commodity trading. Among them, peer-to-peer energy trading accounts for the largest share, accounting for 31.36% in 2023.

From a regional perspective, the global blockchain in energy market is dominated by two major regions: North America and Europe. Among them, Europe is the largest revenue market. Data shows that in 2023, the blockchain in energy market revenue in Europe was $535 million, with a market share of 48.11%; The North American market share is 23.04%. In addition, the blockchain in energy market in the Asia Pacific region is expected to rapidly develop in the coming years, becoming the fastest-growing market.

Global Blockchain in Energy Market Revenue and Share by Type, Application,

and Region in 2023

|

|

Market Revenue (Million USD)

|

Share

|

|

Segmented by Type

|

|

Public Blockchain

|

3.73

|

33.52%

|

|

Private Blockchain

|

3.17

|

28.53%

|

|

Federated Blockchain

|

1.65

|

14.85%

|

|

Hybrid Blockchain

|

2.57

|

23.10%

|

|

Segmented by Application

|

|

Wholesale Electricity Distribution

|

2.58

|

23.16%

|

|

Peer-to-peer Energy Trading

|

3.49

|

31.36%

|

|

Electricity Data Management

|

2.20

|

19.77%

|

|

Commodity Trading

|

1.78

|

15.98%

|

|

Others

|

1.08

|

9.73%

|

|

Segmented by Region

|

|

North America

|

3.52

|

23.04%

|

|

Europe

|

5.35

|

48.11%

|

|

Asia Pacifica

|

1.30

|

11.69%

|

|

South America

|

0.52

|

4.68%

|

|

Middle East & Africa

|

0.42

|

3.78%

|

Source: www.globalmarketmonitor.com

For more industry information, please refer to our latest released "2023 Global Blockchain in Energy Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".