US Rapid Oral Fluid Screening Devices Market Overview

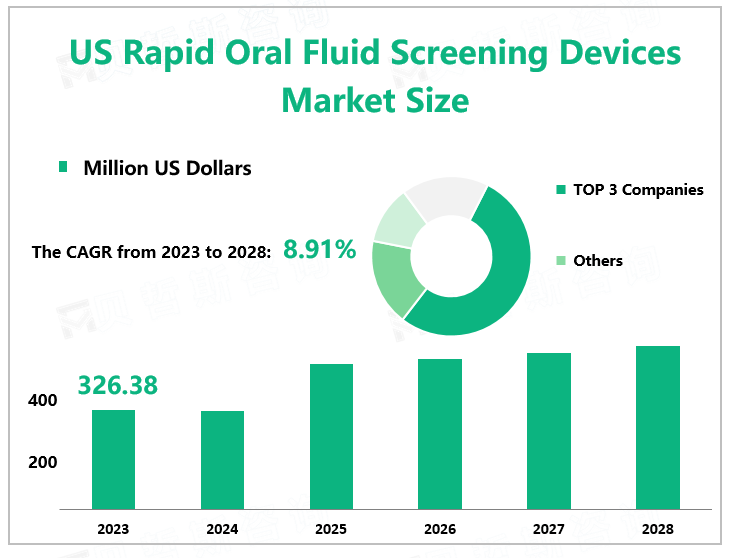

According to Global Market Monitor, the US rapid oral fluid screening devices market size will reach $326.38 million in 2023 with a CAGR of 8.91% from 2023 to 2028.Rapid oral fluid screening devices are used to collect an oral fluid sample from a test subject and analyze it for the presence of hormones, drugs, antibodies, or other molecules. They are commonly used both in clinical and forensic settings.

SAMHSA's mandatory guidelines have served as a blueprint for many national drug-testing laws, corporate drug-testing policies, and legal arguments for how to conduct drug testing the right way since the original guidelines were issued in 1988. Besides, FDA clearance is the most reliable standard to look for with any drug testing device. With the easing of SAMHSA policies, the increase in FDA-approved products has given rapid oral fluid screening devices more room to grow.

Time and Cost Saving

Oral fluid collection takes less time than urine collection and reduces the amount of time employees spend away from the workplace, thereby reducing costs to employers. Oral fluid collection does not require facilities to provide visual privacy during the collection process. Unlike urine specimen collection, many oral fluid collections can be performed at or near the workplace, rather than at a dedicated collection site. The collector can be near the donor and in cases where the donor is unable to provide oral fluids, the collection of a urine specimen may be an option.

Regional Constraints

State laws for drug testing vary across UA, though many places permit all types of drug testing, some have unique requirements and limitations. For instance, Maryland only allows hair specimens to be used for pre-employment drug testing, and other states, like Hawaii, Maine, Puerto Rico, and Vermont, prohibit the use of oral fluid drug testing altogether. In addition, San Francisco, California, and Boulder, Colorado, prohibit random drug testing for all employees, and other states allow random testing only for safety-sensitive employees, EAP, and specified circumstances. Even though there is market demand, differences in legislation from state to state have limited the popularity of rapid oral fluid screening devices to some extent.

|

Multiple demands for rapid oral fluid screening devices |

|

|

Time and cost saving |

|

|

Limitations |

Regional constraints |

|

There is a wide variation in products. |

|

|

Opportunities |

Relaxation of regulatory regulations |

We provide more professional and intelligent market reports to complement your business decisions.