Global Core Banking System Market Overview

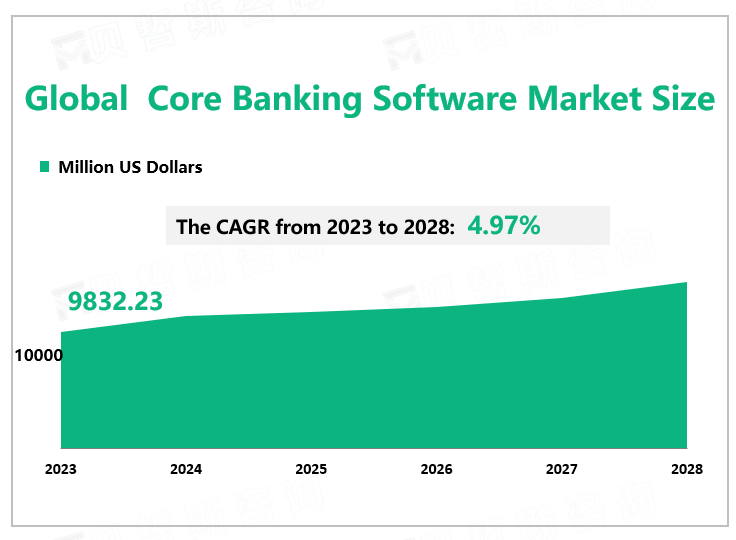

According to Global Market Monitor, the global core banking system market size will reach $9832.23 million in 2023 with a CAGR of 4.97% from 2023 to 2028.

A core banking system is the software used to support a bank’s most common transactions. Elements of core banking include making and servicing loans and opening new accounts, processing cash deposits and withdrawals, processing payments and cheques, calculating interest, and customer relationship management (CRM) activities.

Core Banking System Market Trends

For many years, banks have been using the cloud for non-critical systems such as email, application development, and customer relationship management. However, adoption for core banking systems had been hindered due to concerns over cloud security, regulations, and the transformational effort to migrate to a cloud deployment. But this tide has turned, with bank executives and IT teams beginning to fully embrace cloud technology/deployments thanks to advances including the growing popularity and success of direct bank launches,a better understanding of bank regulators about cloud information, the ability of core solution providers in cloud-native core banking software solutions. It could be a big chance for banking software vendors.

Market Drivers and Challenges

The current digital experience that banks provide to their customers is very limited to one-way conversations or a few fledgling two-way conversation use cases. Financial institutions have yet to effectively use advanced Artificial Intelligence (AI) and Machine Learning (ML) to engage their customers in fuller intelligent, interactive, two-way conversations. By using AI/ML-powered technology, banks can provision relevant two-way conversations that help recapture the leading position that they used to maintain in their customers’ financial lives.

After running core banking software for many years, problems such as high maintenance costs, closed system architecture, difficulty in adding new features, and downtime may occur. With the continuous updating of the banking business, the core software also needs to be improved. Although the risk of system replacement is reduced as technology advances, updating old systems is still very complex and may disrupt business operations during system replacement.

|

By Type |

Cloud-based |

|

On-premises |

|

|

The On-premise segment contributed a largermarket share. |

|

|

By Application |

Retail Banks |

|

Private Banks |

|

|

Corporate Banks |

|

|

The retail banks occupied the biggest share in 2022. |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

|

|

North America Led the Market. |

We provide more professional and intelligent market reports to complement your business decisions.