Rapid oral fluid screening devices are used to collect oral fluid samples from test subjects and analyze them for the presence of hormones, drugs, antibodies, or other molecules. It is widely used in clinical and forensic settings because of its portability, ease of operation, and small sample size.

Overview of Market Development

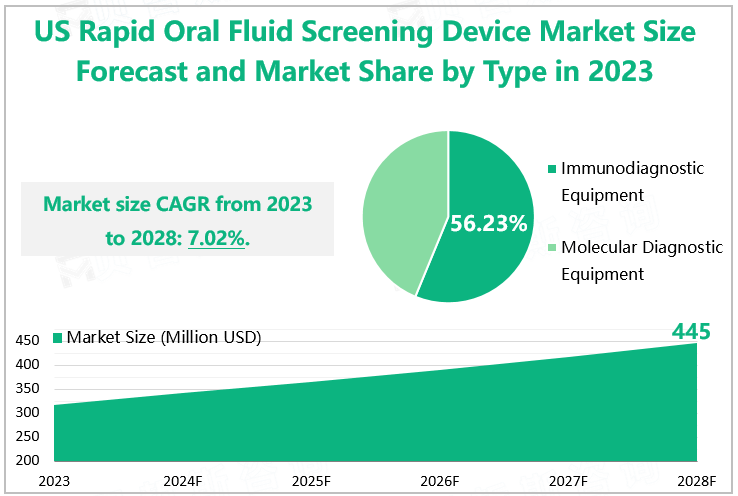

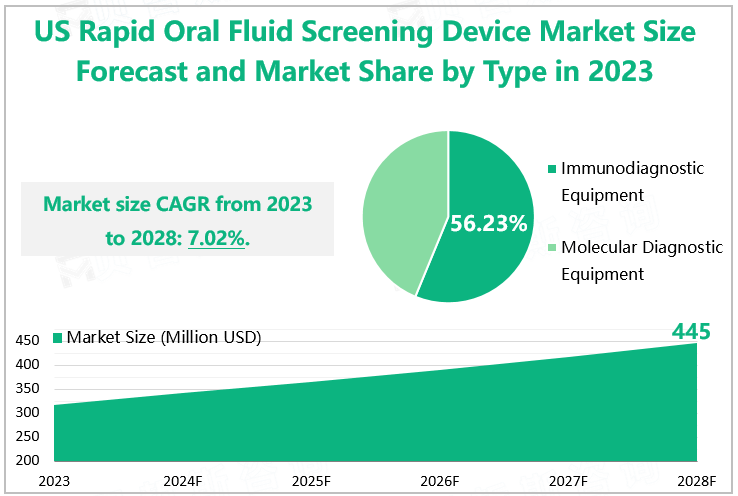

Data shows that the US rapid oral liquid screening equipment market size in 2023 was $317 million, an increase of 6.73% compared to 2022. In the future, with the continuous development of technology, rapid oral fluid screening equipment will be further improved in terms of technical performance and accuracy, which will help improve the reliability and market acceptance of the equipment. In addition, with the relaxation of SAMHSA policies and the increase of FDA-approved products, the rapid oral fluid screening equipment market will usher in greater development space. It is expected that by 2028, the market size of rapid oral liquid screening equipment in the US will increase to $445 million.

US Rapid Oral Fluid Screening Device Market Size Forecast and Market Share by Type in 2023

Source: www.globalmarketmonitor.com

Market Segment Analysis

According to different detection methods, rapid oral fluid screening equipment can be divided into immunodiagnostic equipment and molecular diagnostic equipment. Immunodiagnosis is a series of experimental methods that apply immunological theory to the determination of antigens, antibodies, immune cells, and their secreted cytokines. Saliva is a biological liquid in immunodiagnosis analysis. Molecular diagnosis refers to the use of molecular biological methods to detect changes in the structure or expression level of genetic material in a patient's body. Rapid oral fluid screening devices can detect the presence of hormones, drugs, antibodies, or other molecules through the molecules in a saliva sample. In 2022, in the United States rapid oral fluid screening equipment market, the market size of immunodiagnostic equipment and molecular diagnostic equipment accounted for 56.23% and 43.77%, respectively.

Regional Analysis

From the perspective of market regional distribution, the market size of rapid oral fluid screening equipment in the western region of the United States in 2023 was $96 million, accounting for 30.28%; The market size of the southern region was $113 million, accounting for 35.65%, which is the largest revenue market of rapid oral fluid screening equipment in US. The market size of the central and western regions and the southeast region was $46 million and $61 million, accounting for 14.51% and 19.24%, respectively.

US

Rapid Oral Fluid Screening Device Market Size and Share by Region in 2023

|

Regions

|

Market Size(M USD)

|

Market Share

|

|

West US

|

96

|

30.28%

|

|

South US

|

113

|

35.65%

|

|

Middle West US

|

46

|

14.51%

|

|

Southeast US

|

61

|

19.24%

|

Source:

www.globalmarketmonitor.com

Market Development

Opportunity Analysis

Since

the original guidelines were issued in 1988, SAMHSA's mandatory guidelines have

served as a blueprint for many national drug testing laws, company drug testing

policies, and the legal basis for how to conduct drug testing the right

way. While alternative testing methods,

including hair testing, point-of-care devices, and laboratory-based oral liquid

testing, have been around for many years, they have not had a significant

market share in laboratory-based urine testing in the workplace. In addition, FDA approval is the most

reliable standard for any drug testing device.

With the relaxation of the SAMHSA policy and the increase of products

approved by the FDA, there will be more room for rapid liquid screening

devices.

For more industry information, please refer to our latest released "2023 Global Rapid Oral Fluid Screening Devices Market Analysis Report, Key Competitors, Market Effect Factors, Growth, And Forecast".